Receipt For Tax Deductible Donations

According to the Internal Revenue Service IRS a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth. Offer valid for tax preparation fees for new clients only.

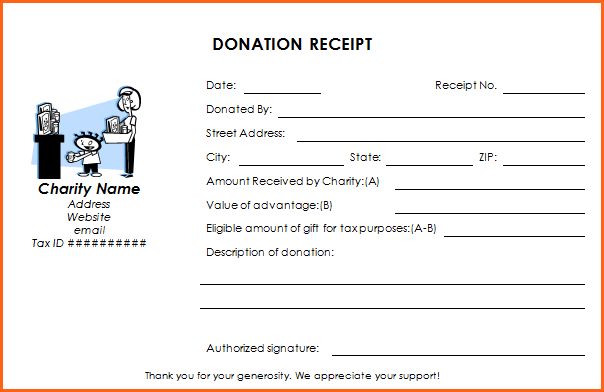

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

How much can you deduct for the gently used goods you donate to Goodwill.

. What is Tax Deductible. It really is the definition of a win win. What Does Tax-Deductible Mean.

In the world of taxes tax deductibles are one of the few things that work in the favor of the taxpayer and reduce taxes for both. Tax-deductible is an expense that can be subtracted from the taxpayers gross income to get adjustable gross income reducing the tax liabilityWhen taxable income is reduced you pay less tax. The Taxpayer Certainty and Disaster Relief Act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021.

Just collect the items you want to donate schedule your pickup and set them outside on your scheduled pickup date. Our donation value guide displays. For example a business may choose to donate computers to a school and declare that donation as a tax deduction.

The IRS allows you to deduct fair market value for gently-used items. Our simple process makes it possible for more charities to benefit from the generosity of donors like you. Only donations actually made before the close of the tax year would be eligible.

Donations to these campaigns and platforms arent deductible. And you must provide a bank record or a payroll-deduction record to claim the tax deduction. The amount you can deduct is equal to the value of all cash and property you donate to the school district programs.

According to the Internal Revenue Service IRS a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth. The federal tax law permits you to use any reasonable valuation method for most property contributions as long as it assesses a value that relates to the price a willing buyer would pay for identical property in the open market. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction.

Charities rely on the generosity of the people who donate money to support them without the generosity of people like you they wouldnt be able to do the great things they do to help good causes. If you made a monetary contribution qualifying documentation includes a bank statement a credit card statement and a receipt. Registered and incorporated it will pay the company tax rate 28.

Amount of deduction. When a gift or donation is deductible. Deductible gift recipients External Link.

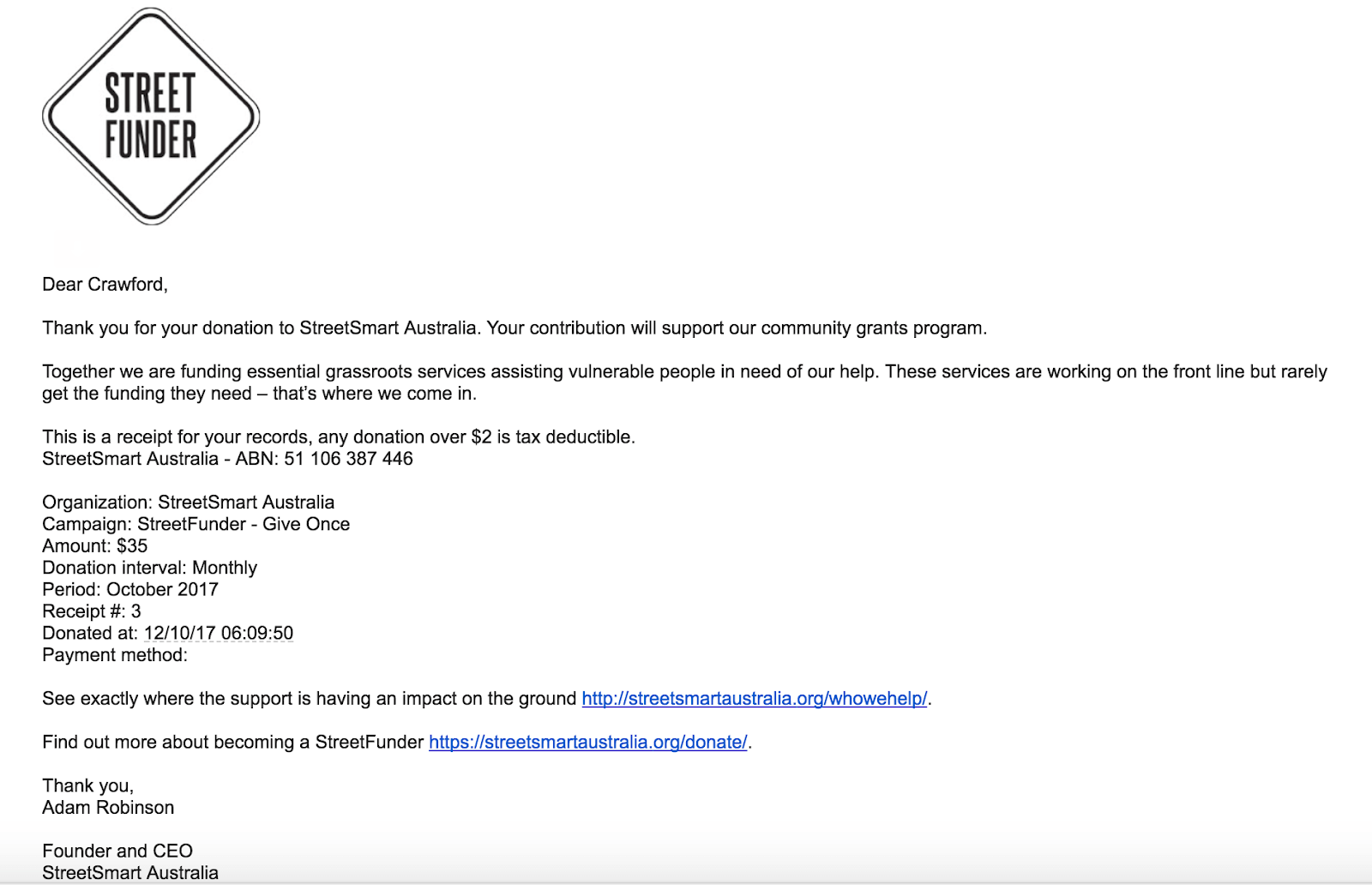

We expertly handle all aspects of processing your used cars send the net sale proceeds to the charity and then you receive a tax-deductible receipt within 2. Understanding your tax receipt. When you donate to a 501c3 public charity including Fidelity Charitable you are able to take an income tax charitable deductionThe purpose of charitable tax deductions are to reduce your taxable income and your tax billand in this case improving the world while youre at it.

You can check the DGR status of an organisation at ABN Look-up. Tax deductible donations are a great way to give your tax refund a boost while contributing to a worthy cause you care about. See what we accept by reviewing our Acceptable Items page.

May not be combined. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. A general rule is that only 501c3 tax-exempt organizations ie.

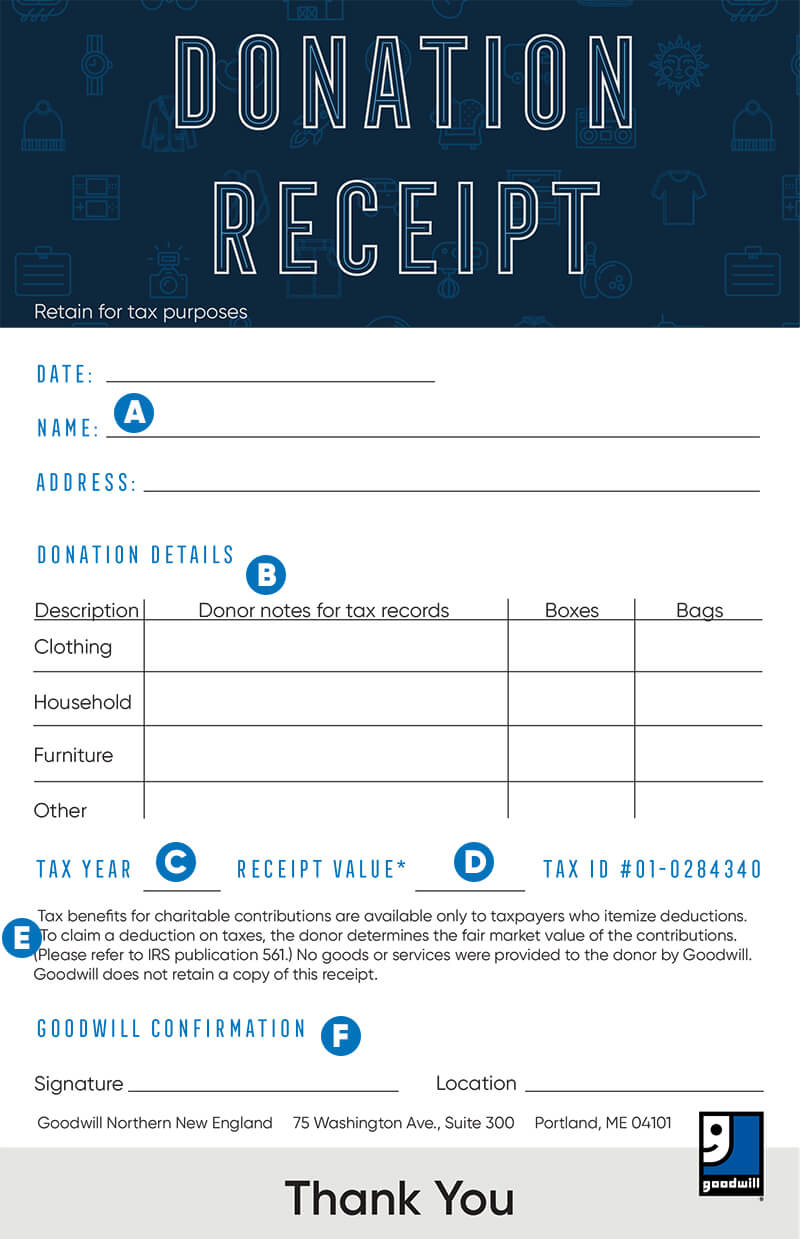

If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations. A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. Bushfire and flood donations If you make donations of 2 or more to bucket collections conducted by approved organisations for victims of natural disasters such as bushfires severe storms or flooding you can claim a tax deduction for these contributions without a receipt provided the total fo these contributions does not exceed 10.

It applies to cash donations of up to 300 or 600 if youre married and filing jointly. GreenDrop accepts many items ranging from clothes toys and much more. Cash donations of 250 or more.

Just make sure your boxes or bags have Purple Heart Foundation and DONATION written on them and theyre easy to get to for our drivers. Incorporated or unincorporated organisations and their tax. When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches.

Double check to make sure that any items donated follow our rules. If your company is a corporation you claim charitable donations on your corporate tax return. To receive a tax deduction the donor.

In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients DGRs. The IRS requires an item to be in good condition or better to take a deduction.

The Purple Heart clothing donation process is easy and convenient and your donation is tax-deductible. Fair market value is the price a willing. You need a receipt and other proof for both of these.

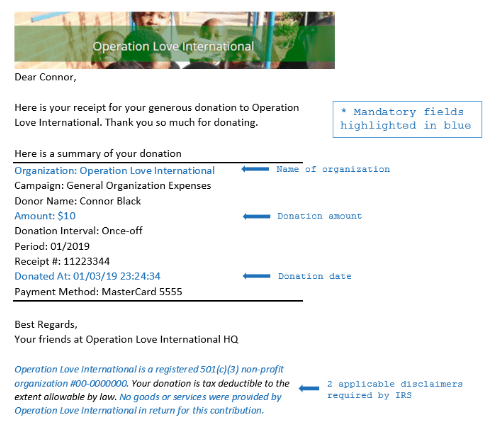

The quality of the item when new and its age must be considered. Updated June 03 2022. Public charities and private foundations formed in the United States are eligible to receive tax-deductible charitable contributions.

Theres financial incentive for Americans to give generously to charity. The tax receipt contains a table that shows how your taxes are allocated to key categories of government expenditure. The rate at which you will pay tax is.

Updated June 03 2022. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250.

Unincorporated it will pay tax based on the individual tax rate. Fair market value is the. During most tax years you are required to itemize your deductions to claim your charitable gifts and contributions.

If your business is set up as a sole proprietorship LLC or partnership you can claim these expenses on your personal tax forms. The sample table below provides an example of how this information is presented on your tax receipt. If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill donations.

After we receive your donations thank you you can download a tax receipt for your records. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. The tax receipt also includes information on the level of Australian Government gross debt for.

Do you have objects you were interested in donating to helping others in need. Keep track of your tax deductible donations no matter the amount. We suggest you contact your tax adviser or accountant or visit the IRS website for more information.

If you itemize your deductions you may be able to deduct charitable contributions of money or property made to qualified organizations. Any educational expenses you incur to bring value to your business are fully deductible for tax purposes. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items.

If your not-for-profit is.

How To Fill Out A Donation Tax Receipt Goodwill Nne

Four Steps To Making Your Charitable Donation Eligible For A Deduction The Scarletredish Rack

Free Goodwill Donation Receipt Template Pdf Eforms

Tax Receipt Sweet Cheeks Diaper Bank

Complete Guide To Donation Receipts For Nonprofits

Mastering The Donation Receipt Steal These Invaluable Tips Must Have Elements Templates By Miles Anthony Smith Medium

Free Goodwill Donation Receipt Template Pdf Eforms

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox